Mile Pal - Car mileage tracker & log app for iPhone and iPad

Developer: Alex Rastorgouev

First release : 10 Oct 2014

App size: 11.57 Mb

Do you need to keep track of your mileage for business, charitable, medical/moving or personal reasons but find paper logs are difficult to maintain? Mile Pal will make that process extremely easy.

IRS tax deduction rates are 56 cents/mile for 2014! Take advantage of these rates by keeping track of the miles you drive for your business, for charity, or for personal medical reasons. With Mile Pal, it’s never been easier to maker a trip log!

KEY FEATURES

=========================================

+ Track every bit of your drive, including distance, time, notes & a lot more

+ Quickly view past drives

+ Average mileage for the month

+ Amazing statistics - average distance and time per drive

+ Set Goals - Easily set a number of goals to track

+ Set your desired monthly distance goal

+ Set mpg that you want to achieve on a drive

+ Stay motivated with gorgeous graphs and statistics

+ 4 stunning graphs (Daily distance, Cumulative, Category - bar, Category - pie)

+ Table view to complement all of the graphs

OTHER AMAZING FEATURES

=========================================

+ Extremely easy to enter past drives!

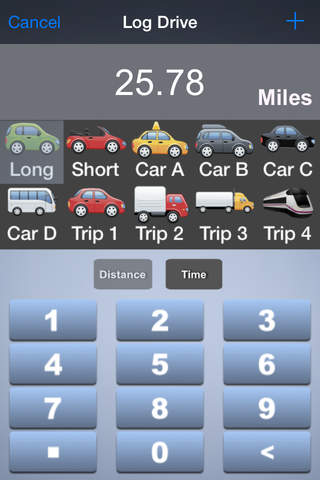

+ Simply enter your distance + time, choose a category and you are done

+ Enter a note (or a reminder) for any entry

+ Choose any date (log upcoming drives as well)

+ All of your drives are conveniently layed out on one page

+ Scroll down to view past entries

+ Switch to the Calendar page to display your drives & distances on a calendar

+ Beautifully crafted icons and interface

+ Intuitive, easy to use interface

+ Switch between Miles and Km

+ Export your data straight to your email